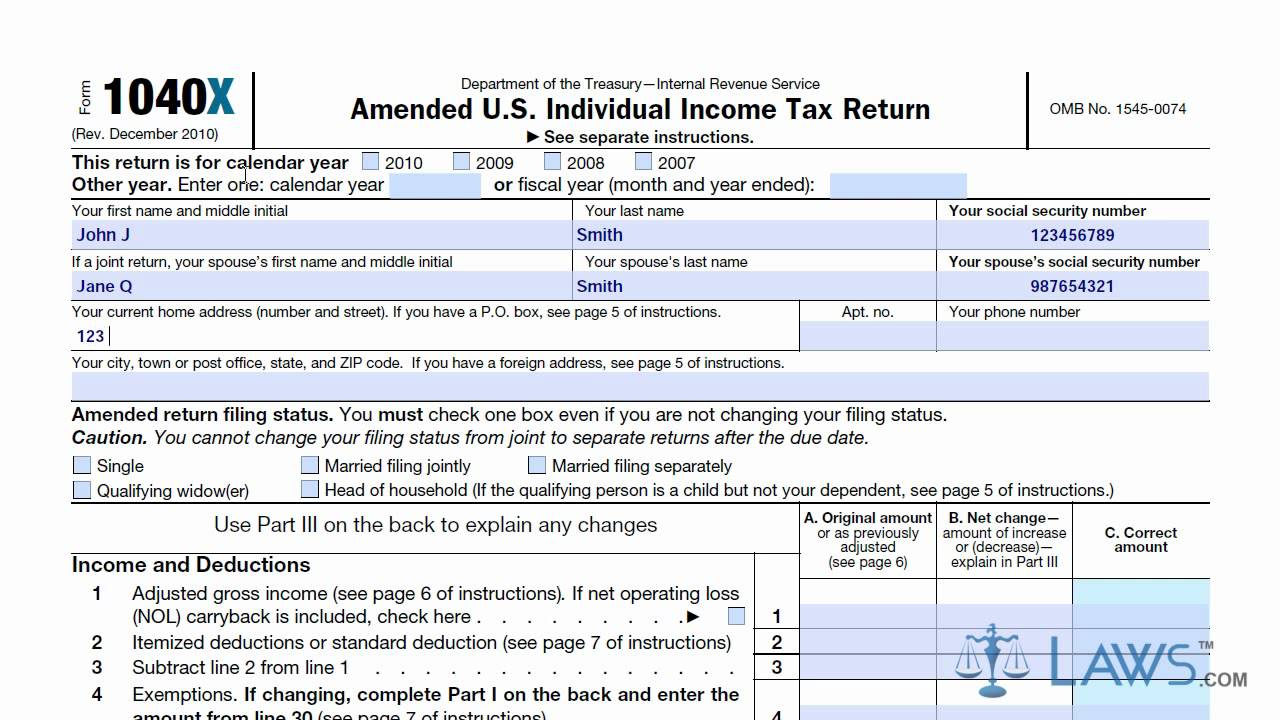

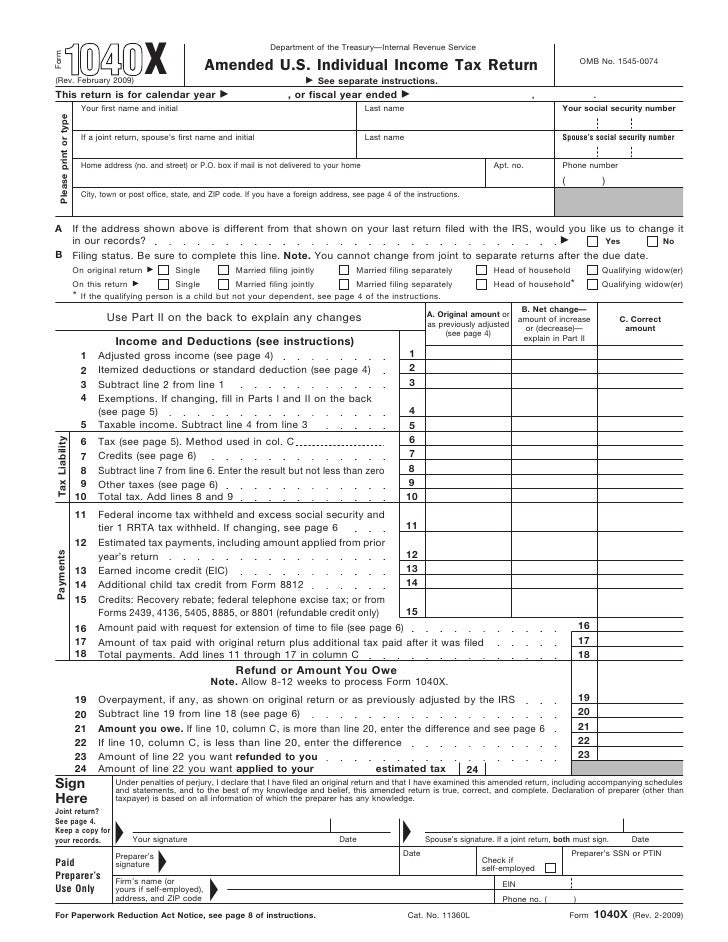

What forms are required with an electronically filed amended return?Īn amended Form 1040, 1040-SR and 1040-NR return requires submission of all necessary forms and schedules as if it were the original submission, even if some forms have no adjustments. Our phone and walk-in representatives can only research the status of your amended return 20 weeks or more after you've mailed it or if Where's My Amended Return? itself has directed you to contact us.

See our operations page for more information about processing timeframes.Īdditionally, calling the IRS will not speed up return processing. The current processing time is more than 20 weeks for both paper and electronically filed amended returns. Will my amended return be processed faster if I file electronically? You can amend tax year 2020, tax year 2021 and tax year 2022 Forms 1040 and 1040-SR returns electronically at this time.Īdditionally, amended Form 1040-NR and corrected Form 1040-SS/PR returns can now be filed electronically for tax years 20. Can I file my amended return electronically for previous tax years? If you file a third amended return that is accepted, all subsequent attempts will be rejected.

How many amended returns can be filed electronically?įilers can electronically file up to three amended returns.

#Turbotax 1040x available software#

How do I file my amended return electronically?Ĭontact your preferred tax software provider to verify their participation, answer any questions and for specific instructions needed to submit your amended return. If amending a prior year return originally filed on paper during the current process year, then the amended return must also be filed on paper.Amended returns for any other tax years or tax forms must be filed by paper. Any amended Form 10-SR returns older than three years, or Form 1040-NR and 1040-SS/PR returns older than 2 years cannot be amended electronically.What are some reasons that an amended return cannot be filed electronically? Amended returns must be filed by paper for the following reasons: Individual Income Tax Return electronically using available tax software products.Īdditionally, amended Form 1040-NR and amended Form 1040-SS/PR can now be filed electronically for tax year 20. If you need to amend your 2020, 2021 or 2022 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Can I file my amended return electronically? It may take up to 3 weeks for your amended return to show in our system. Please note: Due to COVID-19 processing delays, it’s taking us more than 20 weeks to process amended returns.You can check the status of your amended return with the Where’s My Amended Return tool. There’s no need to call the IRS during that three-week period unless the tool specifically tells you to do so.

It can take up to three weeks after filing it to show up in our system. As a reminder, amended returns take up to 16 weeks to process. The online tool includes an illustrated graphic that visually communicates where your amended return resides within the processing stages. Once authenticated, you can view the status of your amended return across three processing stages - Received, Adjusted, and Completed.

#Turbotax 1040x available code#

When using either tool, you must enter your taxpayer identification number, such as your social security number, along with your date of birth, and ZIP code to prove your identity. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to three prior years. Individual Income Tax Return using the Where's My Amended Return? online tool or by calling the toll-free telephone number 86 three weeks after you file your amended return. You can check the status of your Form 1040-X, Amended U.S.

0 kommentar(er)

0 kommentar(er)